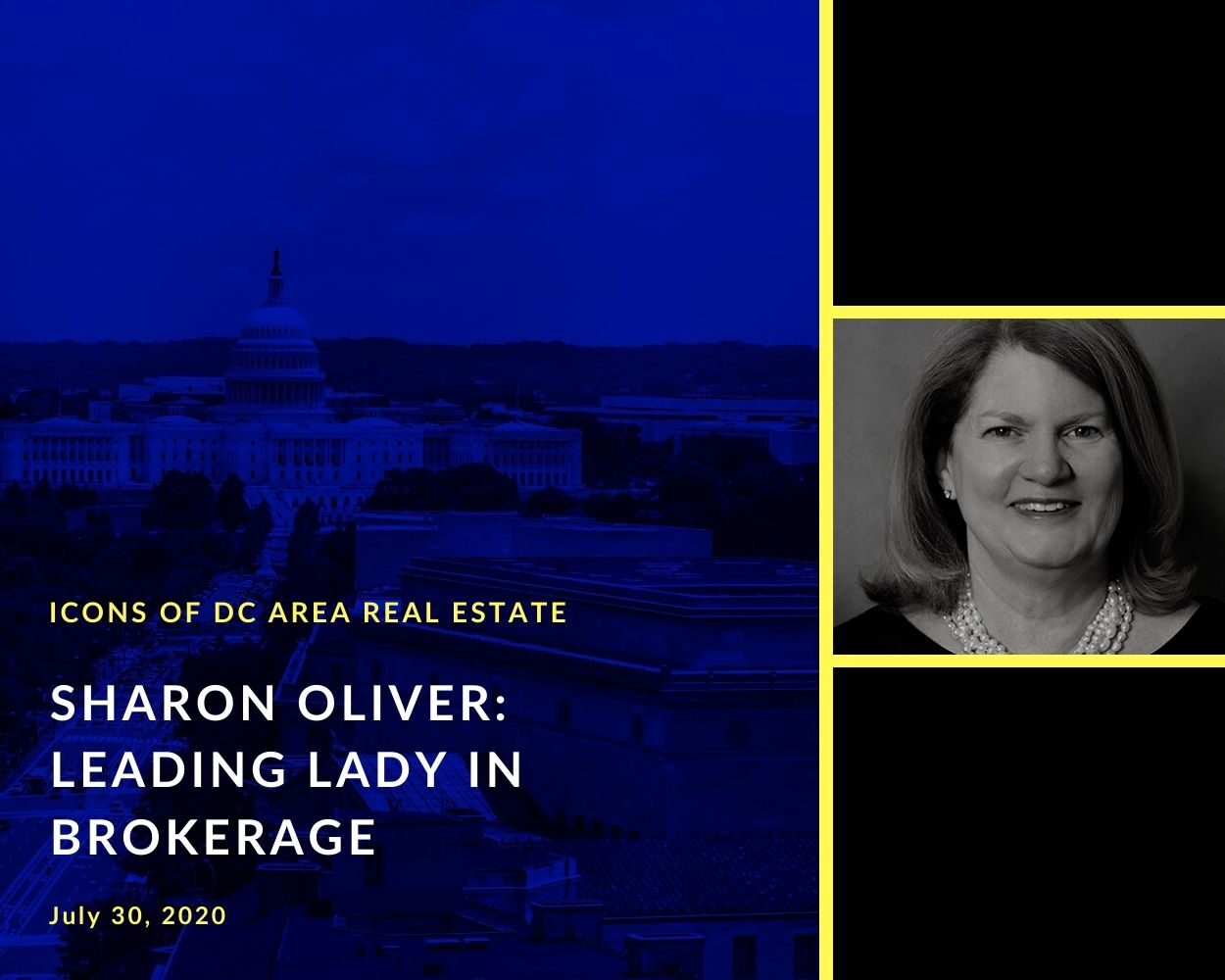

Bio

Principal, 2004-Present

Meany & Oliver Companies, Inc.

Sharon Oliver co-founded Meany & Oliver Companies Inc. in 2004. The firm provides investment, leasing and consulting services in the Washington, DC Metropolitan Area. Major transactions have included the 625,000 square foot Corporate Executive Board lease at Waterview which, at the time, was the largest private sector office lease ever completed in the Washington, DC metropolitan area and the 300,000 square foot build-to-suit lease with Chemonics International at The Yards. Major clients have included Alexandria City Public Schools, American Physical Therapy Association, Brookfield Properties, The JBG Companies, Forest City, Peterson Companies, Quadrangle Development, Southern Management Corporation, United Mine Workers of America, Weisbrod Matteis & Copley and The Wilkes Company.

Principal, 1999 – 2004

The JBG Companies

Ms. Oliver had overall responsibility for the leasing and management of The JBG Companies’ entire commercial portfolio. This portfolio consisted of approximately 20 million square feet of office space, both existing and under development. Projects included 1601 K Street, Potomac Center, Arlington Gateway, Chase Tower, 1801 N. Lynn Street and Twinbrook Metro Center. Major transactions included Kirkpatrick & Lockhart, Watson Wyatt, The Ritz Carlton Headquarters, and CapitalSource. Additionally, she completed over one million square feet of GSA leases including the FEMA Headquarters lease and the State Department lease at 1801 N. Lynn Street.

Senior Vice President, 1990 – 1999

Grubb & Ellis of Metropolitan Washington, D.C.

Ms. Oliver directed the activities of the suburban leasing and sales operations. She was an active broker representing the interests of major developers and significant tenants in the marketplace. Clients included IBM, ADP, Kaiser Permanente, Lerner Enterprises, Prudential, and The JBG Companies. As a member of Grubb & Ellis’ Circle of Excellence, Ms. Oliver was designated as one of the top 100 brokers at Grubb & Ellis.

Commercial Real Estate Broker, 1977-1990

Ms. Oliver was an active leasing and sales broker at Barrueta & Associates and Rubloff, Inc. At both firms, she earned top producer awards. She started her career at The Equitable Life Assurance Society of the United States where she was responsible for leasing, disposition, sales and asset management.

Education

Ms. Oliver graduated from Goucher College with a B.A. in Economics and received an MBA in finance from The George Washington University.

Show Notes

Current

- Meany & Oliver- Small boutique firm that brings experience to the brokerage assignments (5:15)

- Changing playbook every day

- 5 People in the Firm (6:45)

- Phil Meany, Co Managing Partner

- Martin Griffin, Principal

- Marty Almquist

Origin Story

- Native Washingtonian- Grew up in Bethesda and then Rockville (7:15)

- Woodward H.S. in Rockville (7:50)

- Grandfather was founder of H.G. Smithy Company (predecessor of Smithy Braedon) (8:00)

- Listened to his family’s discussion of real estate when a child (8:30)

- Wrote a story about her Grandfather as an essay and it had an influence on her future (9:00)

- Team sports contributed to her team spirit (9:35)

- Grandparents had huge influence on her life (11:20)

Education

- Went to Goucher College in Baltimore (all women’s college) (9:50)

- Economics Major

- Adapting to a private women’s college was “interesting” (10:50)

Career Arc

- First job was at Steffey Company in mortgage servicing in Baltimore (12:40)

- Stayed in Baltimore until graduation from college (13:30)

- Moved back to DC area since Baltimore was somewhat “local” (14:25)

- Economics research job initially that she hated (15:10)

- Interviewed with Equitable Life and joined Real Estate Division (15:40)

- Was given many responsibilities early on (16:25)

- On the job training. Story about “Training Program” and she was not accepted because she was a woman and the slot was filled (16:55)

- She went on to get an MBA at GW that was paid for by Equitable (17:50)

- Allan Scott- Mentor that taught her basics and introduced her to contacts (18:30)

- Taught her the importance of relationships

- Keep your existing clients (19:00)

- Eventually led the leasing efforts for Equitable

- Used Blacks Guide for sourcing space for tenants (19:55)

- Oliver Carr Company– Equitable’s largest client (20:40)

- International Square (Involved in negotiations of JV)

- Metropolitan Square (Involved in negotiations of JV)

- Managed all of the leasing activity outside of Carr’s projects (21:25)

- Story about a Twinbrook area portfolio acquired by Equitable that became her portfolio to lease through four employers subsequently (21:55)

- When leaving Equitable to Rubloff she took this portfolio on as a listing agent (24:08)

- Began with Rubloff by taking on Equitable’s portfolio in Montgomery County, MD

- Rubloff (Chicago based firm) was active in Montgomery County and was interested in expanding there (24:30)

- Stayed there three years until hired by Fern Barrueta, who started his own company after leaving Smithy Braedon (25:50)

- Barrueta hired her as a partner to run the Montgomery County leasing activity (26:30)

- Was an entrepreneurial boutique office leasing and sales firm

- Left Barrueta to join Grubb and Ellis (large national firm, now Newmark, Knight, Frank) to bring a national perspective to her business (28:00)

- Worked closely with Phil Meany who led the local office for them (28:30)

- IBM was client there

- JBG was a large client and was eventually hired her away (29:30)

- Joined JBG as a principal in leasing

- Mike Glosserman was a mentor for her that she had met at Equitable and became a mentor to her and eventually brought her into the fold (29:42)

- Sold to Trizec Hahn in 1998 and she went there in 1999 and only 20 people were there at the time

- Discussion about Mentorship (31:15)

- Believes strongly that mentorship is critical— she now mentors women to not worry about who you are and just become “one of the guys” to fit in and develop relationships (31:30)

- Belongs to group for senior real estate women (32:30)

- Brokerage challenges as a woman

- Sharon looks at life and asks “Why not?” (34:45)

- Business hasn’t changed too much since the beginning of her career about being the only person in the room (35:00)

- Always remember who you are as a woman (35:50)

- Sometimes you just have to “take it”- Point of negotiation is to get people to agree (37:10)

- Be assertive but not overly assertive (37:40)

- Developed JBG relationship from Equitable days after meeting Joe Gildenhorn regarding a Bendix deal in Prince Georges County (38:45)

- Discussed taking a listing from Lerner across the street from a JBG project and then was hired by JBG (39:45)

- ICE HQ (40:33)

- Kirkpatrick and Lockhart- 1601 K St. NW (40:40)

- Arlington Gateway (41:03)

- Waterview (41:10)

- Decided to leave JBG to start firm with Phil Meany to stay focused on leasing brokerage (41:45)

- Started Meany and Oliver and was given the entire JBG portfolio to lease (42:20)

- No issues at JBG, but development was the focus and she wanted to market and lease (43:30)

- Worked way too long and hard at JBG to have more control over her life with more flexibility (44:15)

- Combination of Phil Meany leaving Grubb and Ellis and her situation created the opportunity (45:30)

- Didn’t want to oversee large brokerage office with many inexperienced young brokers (46:00)

- Built business on relationships (47:00)

- Learned what not to do at Barrueta…saw many mistakes of growing too large (47:25)

- Won up against large firms because of their focus and experience (48:30)

- Big win- Mt. Vernon Place deal with Quadrangle and Wilkes Company against large firms (48:45)

- On project for 15 yrs. now and helped with each assignment for multiple sites and projects (49:35)

- Evolution of brokerage business (50:30)

- Wild Wild West when it began in the 1970s (50:45)

- Hated cold calling- not productive (51:10)

- Fewer brokers in the 1970s, but grew 4 fold in the 1980s (52:15)

- Now firms are more institutional and segregated among different specialties (53:20)

- Meany and Oliver is unspecialized and will adapt to whatever the client needs (53:30)

- Provide more services and add value more creatively

- Used to be a locker room environment early on, but now people are more sensitive about behavior (54:50)

- Most people are friends among other firms and very collegial (55:40)

- Story about Ray Ritchey- Sharon agrees that brokers from other cities don’t have the same perspective about collegiality (57:00)

Market Conditions

- Comparison of today with past crises (58:30)

- She reflected back on the late 1980s and the other crises (59:00)

- Pandemic is across the board and creates too much uncertainty (1:00:00)

- Not a business related recession (1:00:25)

- Representing tenants and they have no clue about what they will function going forward (1:00:45)

- Impact on office leasing uncertain (1:01:40)

- Story about a client wanting 30,000 s.f. and changed to 15,000 s.f. and decided not to commit to space (1:02:15)

- Client building a building for themselves- looking to adapt space to open plan office space with a few enclosed offices- adapting to reduction in use of space and reduced footprint from 120,000 s.f. to 60,000 s.f. (1:03:15)

- In office for shifts with more sharing of spaces among staff. Conference spaces need to be cleaned and spaced accordingly to accommodate “social distancing” (1:06:30)

- Maybe you are “net zero” for space use (1:08:15)

- Elevators, bathrooms, parking garage, public transportation and other close areas will have impact on demand (1:10:00)

- Cost of space increased 30% since beginning of pandemic (1:11:30)

- Commodity space will become less and less in demand (1:12:00)

- Office market is forever changed to more adaptive “at home” and “at office” use (1:12:30)

- Highest vacancy rate in history in DC (1:13:10)

- Transactions continue, but slower…more creativity needed (1:13:30)

- Case Study with Alexandria Public Schools (1:14:20)

- Study of existing buildings and convinced them to convert office building into an elementary school (1:14:40)

- Series of older office buildings being converted to condo residential buildings (1:15:30)

- Look at brokerage as being in it in the long run (1:16:35)

Philosophy & Audience Questions

- Losses usually turned out to be a “win” (1:17:25)

- Wins- Winning Mt. Vernon Place, The Yards, Corporate Executive Board deal (1:18:00)

- Every day is a “win” to Sharon (1:18:50)

- “Hang on for the ride” (1:19:20)

- “Spend to your worst years” to stay solvent during the lean times (1:19:30)

- Keep integrity and work hard (1:20:14)

- “Don’t be afraid“- Take the risks while being young (1:20:25)

- Billboard- “Dream big, never underestimate what you can achieve” (1:21:00)

- Question- How was starting a partnership being the right decision? (1:21:50)

- Both understood what they want out of a partnership (1:22:00)

- Do it for the long run (1:22:25)

- Question- How do you pick out a mentor and to nurture that relationship? (1:22:45)

- Networking is critical and be interested in what people are doing (1:23:05)

- Senior people are interested in seeing young people succeed (1:23:30)

- Get out of the bubble and meet people (1:23:50)

- Discussion about women in real estate (1:25:00)

- Sharon’s perspective from Goucher

- Time at Equitable when only one woman in a training program

- Reference to Malcolm Gladwell podcast for “Roll Call” citing a woman in the 19th Century being nominated for The Royal Academy that is predominantly male oriented. (1:27:00)

- Moral Licensing- Notion of hiring a woman looking at hiring on an individual basis

- Countries that nominated women for leadership

- Executive levels for women- 16% women in leadership roles in comparative companies in real estate (other podcast guest companies)

- Real Estate industry is very diverse with many more options (1:32:00)

- Expansion of opportunities

- Cognizance of the need for more women and minorities