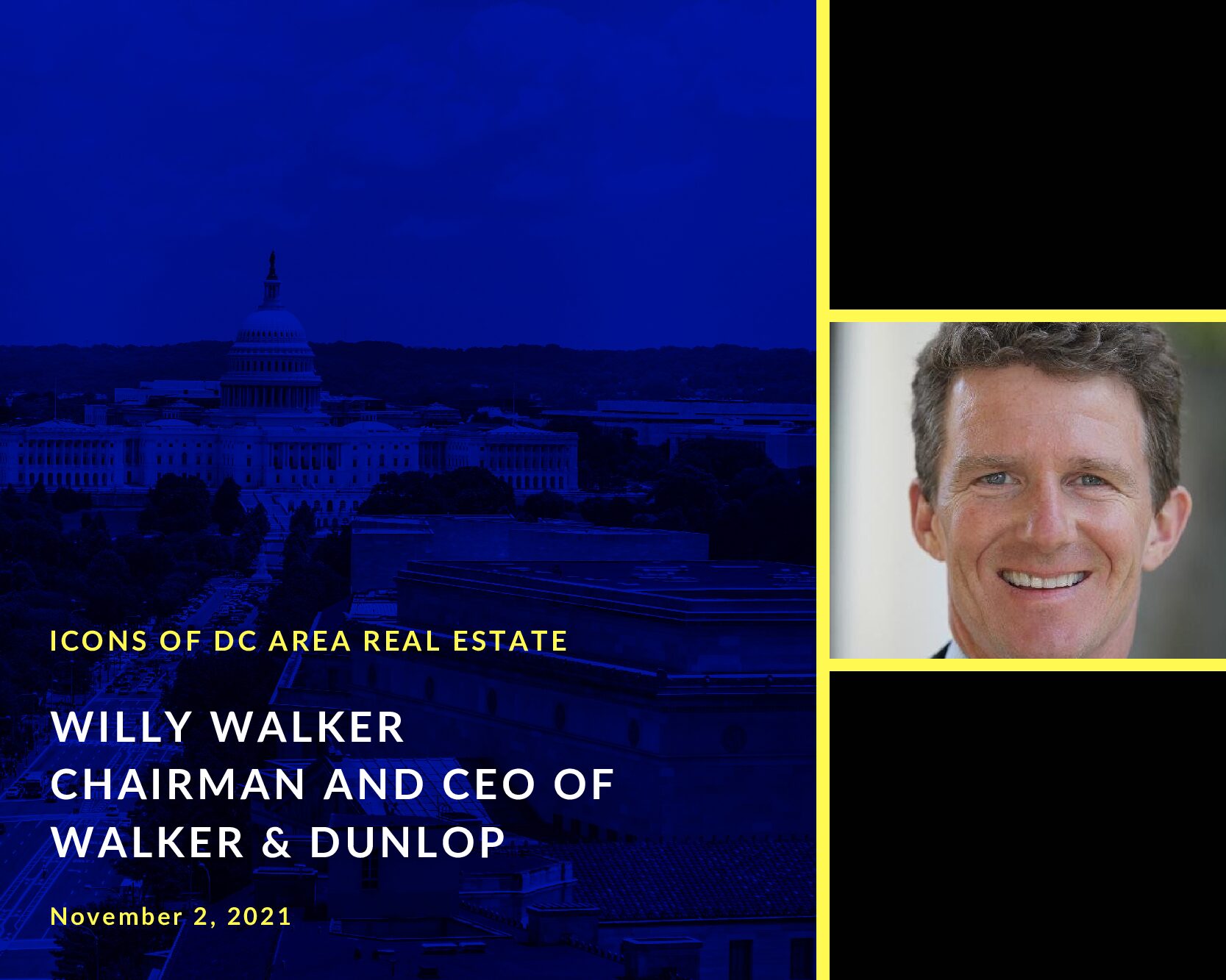

Bio

Willy Walker is chairman and chief executive officer of Walker & Dunlop. Under Mr. Walker’s leadership, Walker & Dunlop has grown from a small, family-owned business to become one of the largest commercial real estate finance companies in the United States. Walker & Dunlop is listed on the New York Stock Exchange, and in its first ten years as a public company has seen its shares appreciate over 800%. The firm was also #17 on Fortune’s 2017 list of “Fastest Growing Public Companies”, and has been named a Best Workplace for five of the past six years by the Great Place to Work® Institute. Mr. Walker received the Ernst & Young Entrepreneur of the Year award in 2011 and was named “Financier of the Year” in 2017 by Commercial Mortgage Observer.

Mr. Walker received his master’s degree in business administration from Harvard University and a bachelor’s degree from St. Lawrence University. He formerly served on the boards of St. Albans School, the Mortgage Bankers Association, and Children’s National Medical Center. Mr. Walker is also a member of the Real Estate Roundtable. Mr. Walker is an avid runner, skier and cyclist, and has run the Boston Marathon in 2:36

Show Notes

- Current Role- His role has changed dramatically over the years as the firm has grown exponentially (4:25)

- Big company capabilities with a small company feel (5:10)

- Travel frequently to keep the culture “small company” (5:45)

- Keep the “Walker Way” constant as a culture for the company (6:10)

Origin Story

- Father, Mallory Walker, was his predecessor as CEO (8:00)

- Mother, Diana Walker, was involved in politics as White House photographer for Time Magazine (8:15)

- Parents were DC business people and political world with each of his parent’s influences (8:40)

- Away to boarding school and college

- Went to Latin America for 10 years (9:30)

- Had no “grounding” there and had to establish his own relationships and reputation outside his family influences (10:30)

- Got a letter from friends in the US telling him of their exploits and he was reading books (11:10)

- Instead of going to Wall Street he went to Paraguay in 1989 after school and spent three years there (12:45)

- After going to HBS he then returned to Chile to work for a venture capital firm (13:45)

- Subsequently, he went to TPG and then a call center company called Teletec and went to Argentina (15:00)

- Moved to London to run Teletec in Europe (16:00)

- Ten years of non real estate investment banking experience (16:50)

- Returned to DC to run Walker & Dunlop (17:15)

- Had been on the board from 1998 to 2003 before taking the reins of the company (18:20)

- When he arrived he noticed that politics was talked about in the office and he wanted to eliminate that unless it relates to business (20:10)

- Looked carefully at the fundamentals of the business and its vulnerability due to the brokerage aspect of the business due to its volatility (21:25)

- Servicing portfolio when he joined was $3B and is now $112B generating $300M in annual recurring revenue (22:50)

- Legacy of the New Zealand “All Blacks”- No Dickheads (Jerks)- Created a “No Jerk” policy at W&D yet he had one that provided 70% of his firm’s revenue (23:50)

- Learned that he needed to scale the business to remove the “jerk” from the company (25:40)

- Created first 5 yr. business plan and scaled the company to the point where he could afford to ask him to leave (26:00)

- Approached by a fellow Board member (Ken Rothschild) in 2004 asking why he didn’t go to another company. He responded why not make W&D grow? It then happened. (27:50)

- Going public was stimulated after purchasing AIG’s business debt exposure (28:45)

- First company in the real estate sector to go public post Global Financial Crisis, yet was a “small cap” company of $250M at the time (30:00)

- W&D offering first SOFR adjusted rate bond issuance- JP Morgan is running the book on the issuance and wanted to do it with a real estate firm (31:10)

- Public company gives access to capital markets (33:00)

- Fortress deal selling CW Capital required W&D having the public company’s stock to trade for the acquisition (33:20)

- Acquisition of Column Financial from Credit Suisse in 2009 was first acquisition (34:10)

- Willy brought in the concept of acquiring companies and understood the capital markets way beyond mortgage banking which was a vision that was untraditional in the business (35:45)

- 14 acquisitions (37:00)

- Stock not used as much for acquisition. Its multiple has grown from 8x PE to 16x PE due to business diversity (37:40)

- Companies are sold not bought (40:10)

- Determined to transform W&D into a different company when he began even though it was profitable (40:50)

- Cites Howard Smith as a great partner as he knows the mortgage banking industry well…he’s the Mr. Inside to Willy’s Mr. Outside (41:45)

- Were members of Strategic Alliance Mortgage, a strategy partnership and he was frustrated with its thinking and he left it immediately (43:00)

- In October, 2007 he told the company he would grow revenues, EBITDA, and net income 5x in five years and almost hit them exactly in 2012. This was the first “Five Year Plan” (43:45)

- Since then he succeeded with subsequent Five Year Plans that also met their goals almost exactly (44:45)

- Vision 2020 succeeded almost exactly as planned. Ambitious enough to be difficult but achievable (45:45)

- Drive to 2025 Vision is a model based on past (46:30)

- Analogous to the Jim Collins “Flywheel” concept (47:50)

- Story of watches- his wife gave him a watch when he crossed $1B in market cap. He just bought another watch recently anticipating a $4B market cap. He had “missed” earnings earlier this year and was nervous about analyst reaction. (48:10)

- Q2, 2021- Inscription: “Breathe” and “18x” (50:00)

- Just jumped over JPM, Wells Fargo, and CBRE to be the largest multifamily lender in the company- W&D has much fewer employees (1,200) and have integrated technology to make themselves more efficient (52:00)

- Competitive firms need to scale down employment to be competitive (53:00)

- People, Brand and Technology- Investments in all aspects (53:30)

- Most recent acquisition- Alliant is the 5th largest tax credit investor to expand affordable space (54:20)

- Pandemic stock price began at $75/share, dropped to $25/share in April, 2020 and is now about $175/share (55:30)

- Cites the Southern Management portfolio financing– the largest deal in company history ($2.4B portfolio debt financing) during the pandemic (56:00)

- People coming back to the office now but haven’t mandated it (57:40)

- Flex office vs. ownership- he likes flex office today (58:50)

- New headquarters in Bethesda (59:15)

- Hiring- habitually hired student athletes which causes a feedback loop (1:01:00)

- Recruiting has expanded considerably (1:02:30)

- Diversity is now important- HBCU institutions (1:02:35)

- Competition for talented minority students (1:03:00)

- Aiming at NCCU with a scholarship (1:03:30)

- Skill sets much broader (1:04:10)

- He is shocked that interviewees know as little as they do when they should know what they want and why they are there (1:05:00)

- Discussion of life change that Willy experienced with his separation from his wife and subsequent reconciliation (1:07:15)

- His colleagues at HBS decided they wanted a “life” first before they took a job (1:07:50)

- He took a job anywhere that would take him regardless of environment (1:09:20)

- He almost “burnt the bacon” in his life (1:09:50)

- “Taking Charge of Anger” by Dr. Robert Nay

- Took a quiz to determine his anger and realized he was “off the charts” (1:10:30)

- Anger is driven by “missed expectations” (1:11:30)

- Dr. Nay ran him through the “missed expectations” in life with him and realized his expectations were poorly aligned (1:12:00)

- He was a “control freak” and “put people under his thumb” and realized that it was counter productive (1:13:00)

- He reset his life including with his wife and children (1:14:00)

- Translate things being taken personally to just an event in the world (1:16:00)

- Taking pride in a career and care about you do (1:17:15)

- Learning experience much better when you learn what you don’t want to do or make mistakes (1:18:15)

- Again cites Howard Smith as staying in one firm for 40 years (1:20:00)

- Scale helps grow company’s employment options (1:20:50)

- Advice to 25 yr. old self- Learning through failures and not through successes (1:21:45)

- If one goes to a family company, be a bit more mindful of the legacy of Walker & Dunlop as opposed to Willy Walker, Inc. (1:22:50)

- Competitiveness has been his “brand” and not a “dickhead” (1:23:40)

- Billboard statement: “Truth”- Discusses the conjecture and conspiracy theory and wants to get back to reality and facts. Happy to be away from Washington DC’s political environment (1:25:20)

- Where is there a place for non polarized truth seeking people? (1:27:30)

Postscript

- Colin Madden Interpretation ((1:29:30)

- Founder mentality (1:30:45)

- Growth trajectory (1:31:30)

- Perspective that Willy had a significant past career in management before joining Walker & Dunlop

- Transformational perspective- Column Financial acquisition

- Ability to communicate vision takes a special person to accomplish goals

- No Rules Rules (Netflix) book reference

- Real estate industry has several successful individuals who have egos with an attitude and can be jerks and don’t know that they are that way and use fear to impose their will

- Avoid “cultural terrorists”

- His watch story interested Colin (His watch is a Tudor-a former Rolex brand)

- Discussion of his anger management issues

- Reference to Satya Nadella interview saying that empathy is the most important emotion for leaders today

- Darwinian ability to survive and grow

- Industry changes making data as the new “oil”

Walker & Dunlop Performance Metrics Since Willy Walker Joined in 2003

- Net Worth in 2003 was approximately $25MM. Market Capitalization in October, 2021 is $4.14B, which is over 160x growth

- The above metric translates to $610,000 per day of value creation since Sept. 2003 until today

- Chart of Stock Price right after IPO in October, 2011 to October, 2021

Similar Episodes

- Ben Miller, Fundrise (#1) and (#2)

- Matt Kelly, JBG Smith